NBCUniversal and Comcast Ventures are taking a bet on millennial-focused financial technology app, Acorns.

The companies announced an equity investment in the start-up on Monday that includes a strategic partnership with Comcast-owned CNBC to produce original content with Acorns. The two will team up on articles, videos and eventually live conferences with the aim of increasing financial literacy, the companies said.

The investment was part of Acorns’ latest $105 million funding round, which puts its valuation at $860 million. BlackRock, Bain Capital Ventures, TPG’s Rise Fund, DST and Michael Dell’s MSD Capital also took part in the Series E round. NBCUniversal, which is now Acorns’ biggest shareholder, will also receive a seat on the start-up’s board. It will be filled by CNBC Chairman Mark Hoffman.

“This partnership with Acorns builds on CNBC’s 30-year commitment to democratizing the financial markets helping generations invest for their future,” Hoffman said in a statement. “We are excited to bring together two brands with this shared social purpose to drive value to our viewers, users and customers.”

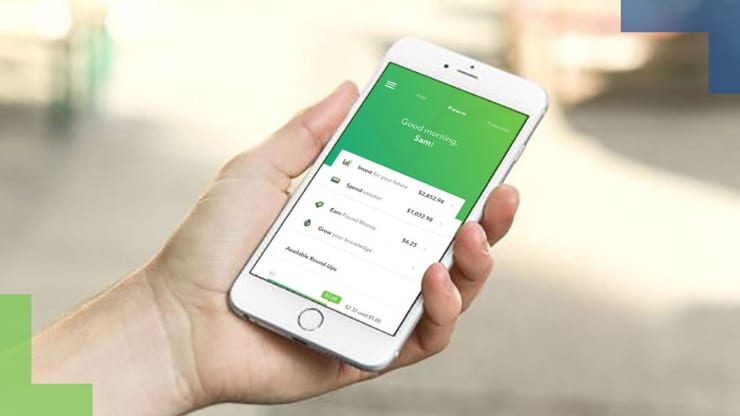

The Irvine, California-based start-up tries to facilitate smart investing by consumers through various services and education offerings. One of its most popular offerings allows customers to automatically invest the spare change from debit or credit card purchases. For example, if an Acorns user bought a cup of coffee for $2.75, the mobile app would round up to the nearest dollar and put that remaining 25 cents into an Acorns investment account. That money is then put to work in professionally managed index funds.

Its automated retirement account service “Acorns Later” has ushered in 350,000 investors who have invested $40 million to date, according to the company.

The 6-year-old start-up already produces its own educational content through its site “Grow. ” CNBC is bringing on a team of about 20 people to expand that effort, which Acorns CEO Noah Kerner said will “take things to the next level” and get useful investing content in front of its 4.5 million customers.

“We’re trying to put the tools of wealth-making in everyone’s hands,” Kerner told CNBC. “We have an imperative to educate people and make them smarter with their money so that they can make the right financial decisions.”

Kerner told CNBC the cash injection should help the start-up expand its product offering and team. Its last publicly disclosed deal was a $50 million investment from BlackRock and inside capital in May, according to Pitchbook. In addition to Monday’s investment from NBCUniversal and Comcast Ventures, the venture capital arm of NBCUniversal’s parent company, Acorns has also attracted minority investments from PayPal Holdings and Greycroft, among others, according to Pitchbook.

‘Broadening access’

A key opportunity, Kerner said, is to educate people right when they go to make a financial decision. A relevant video or article on investing, produced by CNBC, may spring up on the Acorns app as a user goes to try a new product.

“We want to educate at the moment of decision-making and have that knowledge right there in the product,” Kerner said. “That education should happen side by side.”

He describes Acorns as a “financial wellness system,” instead of an investing, savings or fintech app. Other automated investing and trading start-ups like Wealthfront, Betterment and Robinhood have made major inroads in the past decade. Their popularity has been linked to the rise of mobile phones, low-cost technology that makes them leaner than Wall Street incumbents and a lingering distrust in traditional banking after the financial crisis.

The average Acorns customer is around 32 years old with an income of $50,000 to $60,000. The CNBC partnership is designed to reach an “up-and-coming” financial audience that is younger or less financially savvy.

“This is all about broadening access,” Kerner said. “We think it’s a good move to work with a company that’s been democratizing investing for generations.”

No hay comentarios:

Publicar un comentario